The 6-Second Trick For Pacific Prime

The 6-Second Trick For Pacific Prime

Blog Article

More About Pacific Prime

Table of ContentsPacific Prime Fundamentals ExplainedHow Pacific Prime can Save You Time, Stress, and Money.More About Pacific PrimeGet This Report about Pacific PrimeSome Known Facts About Pacific Prime.

Insurance is a contract, represented by a policy, in which a policyholder obtains monetary protection or reimbursement versus losses from an insurer. The firm swimming pools customers' risks to pay a lot more economical for the insured. Many people have some insurance coverage: for their automobile, their residence, their medical care, or their life.Insurance policy also helps cover expenses connected with liability (legal duty) for damage or injury caused to a 3rd party. Insurance is a contract (policy) in which an insurance provider compensates another against losses from particular contingencies or risks. There are numerous sorts of insurance plan. Life, health, home owners, and auto are among one of the most usual kinds of insurance policy.

Investopedia/ Daniel Fishel Lots of insurance plan types are readily available, and basically any kind of specific or business can find an insurance company ready to guarantee themfor a cost. Typical personal insurance coverage kinds are car, health and wellness, home owners, and life insurance coverage. A lot of individuals in the USA contend the very least among these kinds of insurance, and vehicle insurance is called for by state regulation.

See This Report on Pacific Prime

Finding the cost that is ideal for you needs some legwork. Maximums might be established per duration (e.g., annual or policy term), per loss or injury, or over the life of the policy, likewise known as the lifetime maximum.

There are several different types of insurance policy. Wellness insurance coverage assists covers regular and emergency situation medical care prices, frequently with the option to include vision and oral solutions independently.

Numerous preventative services might be covered for totally free prior to these are satisfied. Health insurance may be bought from an insurer, an insurance policy agent, the federal Wellness Insurance coverage Market, offered by an employer, or government Medicare and Medicaid protection. The federal government no more calls for Americans to have wellness insurance policy, yet in some states, such as The golden state, you might pay a tax fine if you do not have insurance policy.

The smart Trick of Pacific Prime That Nobody is Discussing

The company after that pays all or most of the protected costs linked with a car accident or other vehicle damages. If you have actually a leased vehicle or obtained money to get a cars and truck, your lender or renting dealership will likely need you to carry automobile insurance policy.

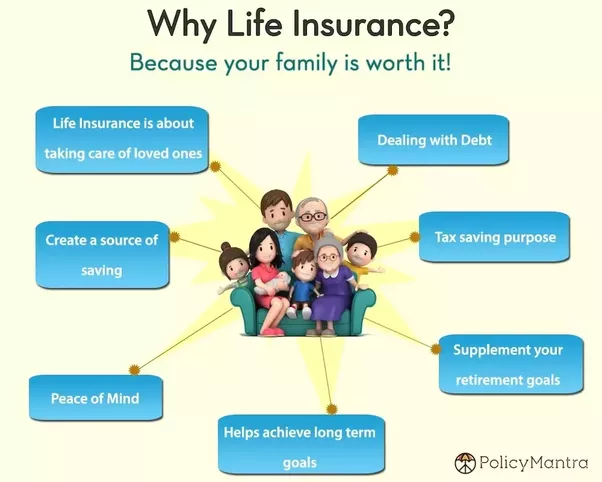

A life insurance policy policy warranties that the insurance company pays a sum of money to your recipients (such as a spouse or kids) if you die. In exchange, you pay premiums throughout your lifetime. There are two primary sorts of life insurance policy. Term life insurance policy covers you for a details period, such as 10 to twenty years.

Permanent life insurance policy covers your entire life as long as you proceed paying the premiums. Traveling insurance covers the expenses and losses connected with traveling, consisting of trip terminations or delays, protection for emergency health and wellness care, injuries and emptyings, damaged baggage, rental cars and trucks, and rental homes. However, even several of the best travel insurer - http://go.bubbl.us/e0d727/3ee9?/New-Mind-Map do not cover cancellations or hold-ups because of weather, terrorism, or a pandemic. Insurance coverage is a method to manage your financial risks. When you acquire insurance policy, you buy security versus unexpected economic losses. The insurance provider pays you or a person you pick if something poor occurs. If you have no insurance and an accident occurs, you might be accountable for all related prices.

The Basic Principles Of Pacific Prime

There are several insurance policy types, some of the most usual are life, wellness, homeowners, and vehicle. The ideal kind of insurance coverage for you will depend on your objectives and monetary circumstance.

Have you ever had a moment while considering your insurance coverage or purchasing for insurance when you've assumed, "What is insurance coverage? And do I truly require it?" You're not alone. Insurance policy can be a mystical and puzzling thing. How does insurance policy work? What are the benefits of insurance policy? And exactly how do you locate the very best insurance for you? These are typical questions, and the good news is, there are some easy-to-understand responses for them.

No one wants something negative to happen to them. Yet suffering a loss without insurance policy can put you in a hard financial circumstance. Insurance coverage is a vital financial tool. It can assist you live life with fewer fears recognizing you'll receive monetary aid after a catastrophe or crash, assisting you recover faster.

Facts About Pacific Prime Uncovered

And sometimes, like car insurance policy and employees' visit this site right here payment, you may be called for by law to have insurance coverage in order to protect others - expat insurance. Learn more about ourInsurance alternatives Insurance coverage is essentially a big nest egg shared by many individuals (called policyholders) and handled by an insurance service provider. The insurance provider uses cash collected (called costs) from its insurance policy holders and various other financial investments to pay for its procedures and to satisfy its pledge to policyholders when they sue

Report this page